Seasoned traders know you must enter the market with a plan and a means to evaluate your performance. A trading journal lets you see what moves have worked, which haven’t, and why, so you can plan strategic future trades that deliver real profits.

When used correctly and consistently, a trading journal can significantly boost your stock performance. This article from Trade Sage explains how. Let’s get started.

What is a Trading Journal

Trading journals come in many forms. Some traders opt for multifaceted software applications that allow for real-time market monitoring. Others are satisfied with the pen-and-paper approach. Sometimes, an Excel sheet gets the job done.

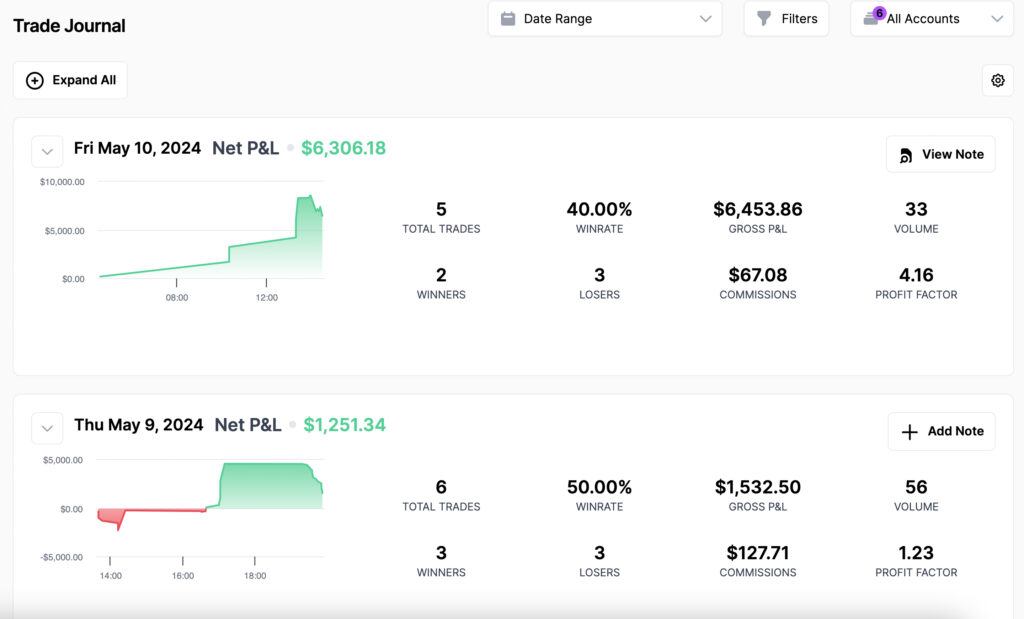

A trading journal is simply a way to track your trading performance. Market conditions continually change, and traders need a reliable means to record trades and the circumstances of those trades and decisions. Recording trades allows you to analyze your performance and learn from investments that yielded profits and resulted in losses, empowering you to make more strategic, informed decisions moving forward.

Must-Haves to Include in Your Trading Journal

Trading journals are as unique as the trader using them. In the same way you should create a trading plan tailored to your goals and needs, your trading journal should serve you and help you execute your unique investment strategies and achieve your goals.

Regardless of your plan or strategy, every trading journal should include a few essential data points for each trade or investment decision:

- Data and time of recording

- Traded asset

- Position size

- Trade direction/strategy

- Entry price, date, and time

- Exit price, date, and time

- Working orders: limits orders and stop-loss

- Profit or loss

- Market condition analysis

- Emotional state before, during, and after the trade

Recording the above data and analyzing it alongside trade results helps you identify correlations among winning trades, guiding and informing future trade decisions.

7 Reasons to Keep a Trading Journal

The stock market is a numbers game. While there’s always risk involved with an investment strategy, having the data at your fingertips allows you to make sober, strategic trading decisions that you can evaluate after the fact.

Data collection and analytics are the primary benefits of keeping a trade journal. Below, we highlight the top seven reasons to keep a trading journal and how having clear data propels you to success.

1. Establish a Routine

Whether you make one trade per day or multiple trades in an hour, it can be easy to forget what led you to make specific investment choices. Recording every step in the trading process lets you know exactly what decisions led to your profits or losses. Keeping a consistent log helps you establish and identify your routines and what works and what doesn’t.

2. Identify Strengths and Weaknesses

Trading isn’t linear. Many variables affect the success of your trading plans and strategies as well as your profits and losses. A trading journal helps you identify strengths and weaknesses in your plan and your natural tendencies as an investor.

A journal lets you see what trading styles, timeframes, and strategies yield the best results. This data helps you do less of what’s holding you back and capitalize on what you’re good at.

3. Improve Risk Management

One of the most significant errors a trader can make is allowing emotions to drive their strategy and trading choices. When this happens, it’s easy to lose sight of the risks and potential loss you could incur.

A trade journal keeps your risk management in check. Before you make the trade, define how much you’re willing to lose. After your trades are finalized, what was the differential? Did you risk (and therefore lose) more than you originally intended or predicted?

Every trade won’t result in a profit. When you lose, look back at your trading journal to understand why. Many times, it’s because you didn’t implement or even consider a risk management strategy.

Recording risks and losses gives you the information to beef up risk management and mitigate future losses.

4. Understand Market Conditions and Patterns

You can’t predict the exact path of the stock market. Too many evolving factors play into market conditions and trading choices.

However, you can analyze patterns to help guide your investments. Logging your moves today allows you to review them in the future when conditions are similar, providing a path to repeat profitable trades and avoid mistakes.

5. Build a Strategy that Works for You

Every trader has a strategy. Sometimes, you stick with a single strategy for a period. Other times, you stack multiple strategies or indicators for specific trades or assets. Keeping track of your strategic approach helps you stay organized and plan your trades before and during your orders.

Adhering to your trading plan is essential for long-term, sustainable, resilient investing. Do you find yourself trying out new strategies? If yes, why? If you keep a consistent, meticulously detailed trading journal, you can answer those questions and build a plan that works for you.

6. Work toward Performance-Driven Growth

Many factors affect the success of your trades. It can be challenging to remember the exact reasons a trade was profitable or not. But when you log relevant details in your trade journal, you can see the conditions, factors, and choices that led to those trade results. Instead of guessing or hypothesizing, you can know what went right, what went wrong, when, and why.

Having all this data in your hands empowers you to work toward performance-driven growth in your trades. Feelings shouldn’t influence you. Fear shouldn’t affect you. Results can and should drive your trades. With a trading journal, you can understand how your choices are impacting performance and make future decisions that help you come out on top.

7. Understand What Drives You

Trade journals help you keep all your trading and investment information in one place. It allows you to analyze the market, assets, risks, and other factors that affect your trading strategy.

But journals do more than organize data. Your trading journal can provide insight into your tendencies, desires, and ambitions as a trader.

As you record, ask yourself what influences you to make the trade and associated investment decisions. Are you afraid of missing out on profits? Do you see other traders winning and want in on the action? Are you just taking guesses at which trades might work?

These are just a few of the many relevant questions every trader needs to ask as they fill out their journals. A trade log helps you analyze data on your trades and yourself to understand what drives you.

Winning the Day with TradeSage

Regardless of the format you choose, you need a trade journal to plan for, understand, evaluate, and adjust your performance in the stock market. At TradeSage, we deliver management and monitoring solutions that allow you to take full advantage of all the market offers.

Check out our investment tools today and see how organizing your trade data will help you see real, lasting stock performance success.